Fha Mortgage Insurance 2024. This means that fha borrowers will encounter two types of mortgage. You can expect to pay.

We use rates collected by bankrate to track daily mortgage rate trends. Loan term—longer than 15 years.

FHA Mortgage Insurance for 2024 Estimate and Chart FHA Lenders, A minimum middle credit score of 580 is usually required to qualify. Updated march 1, 2024 • 3 min read.

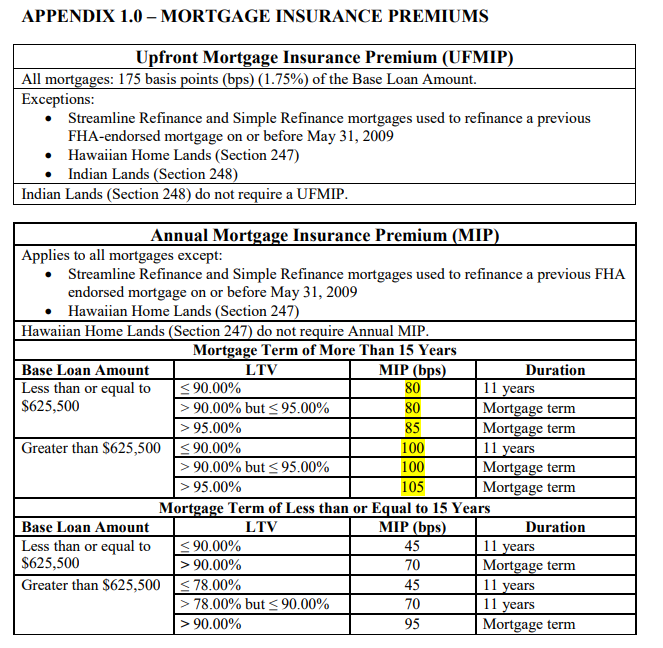

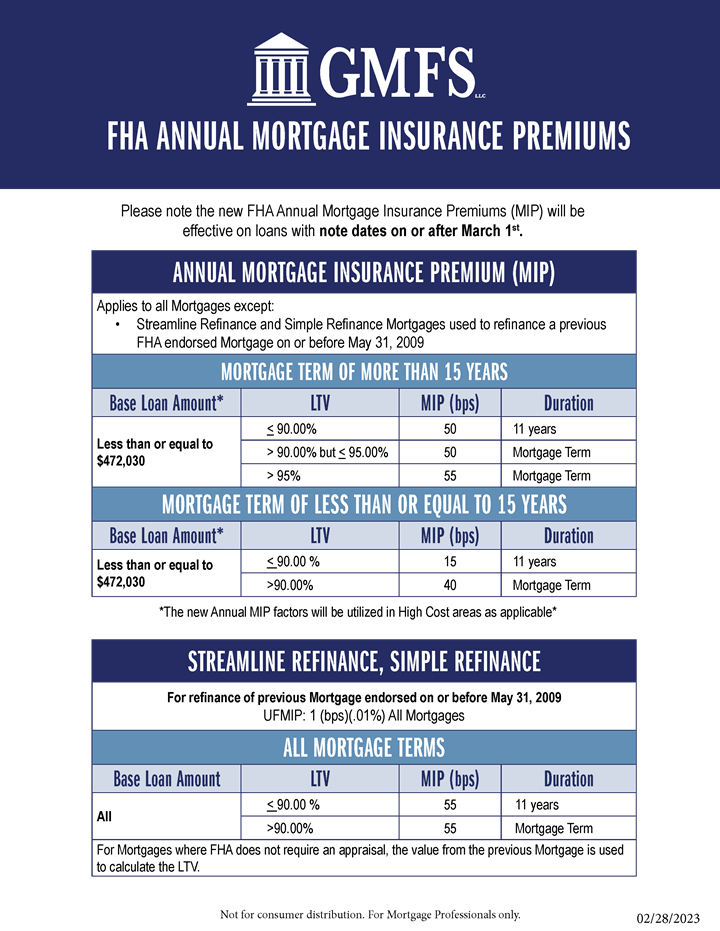

FHA Mortgage Insurance Premium Changes Effective March 1, 2023 GMFS, In february 2023, fha mortgage insurance was reduced by 0.30% of the loan per year from 0.85% to 0.55% for most fha loans. There are two different types of fha mip:

FHA Mortgage Insurance How much is it? Can you cancel it?, Loan term—longer than 15 years. Loan term—15 years or less.

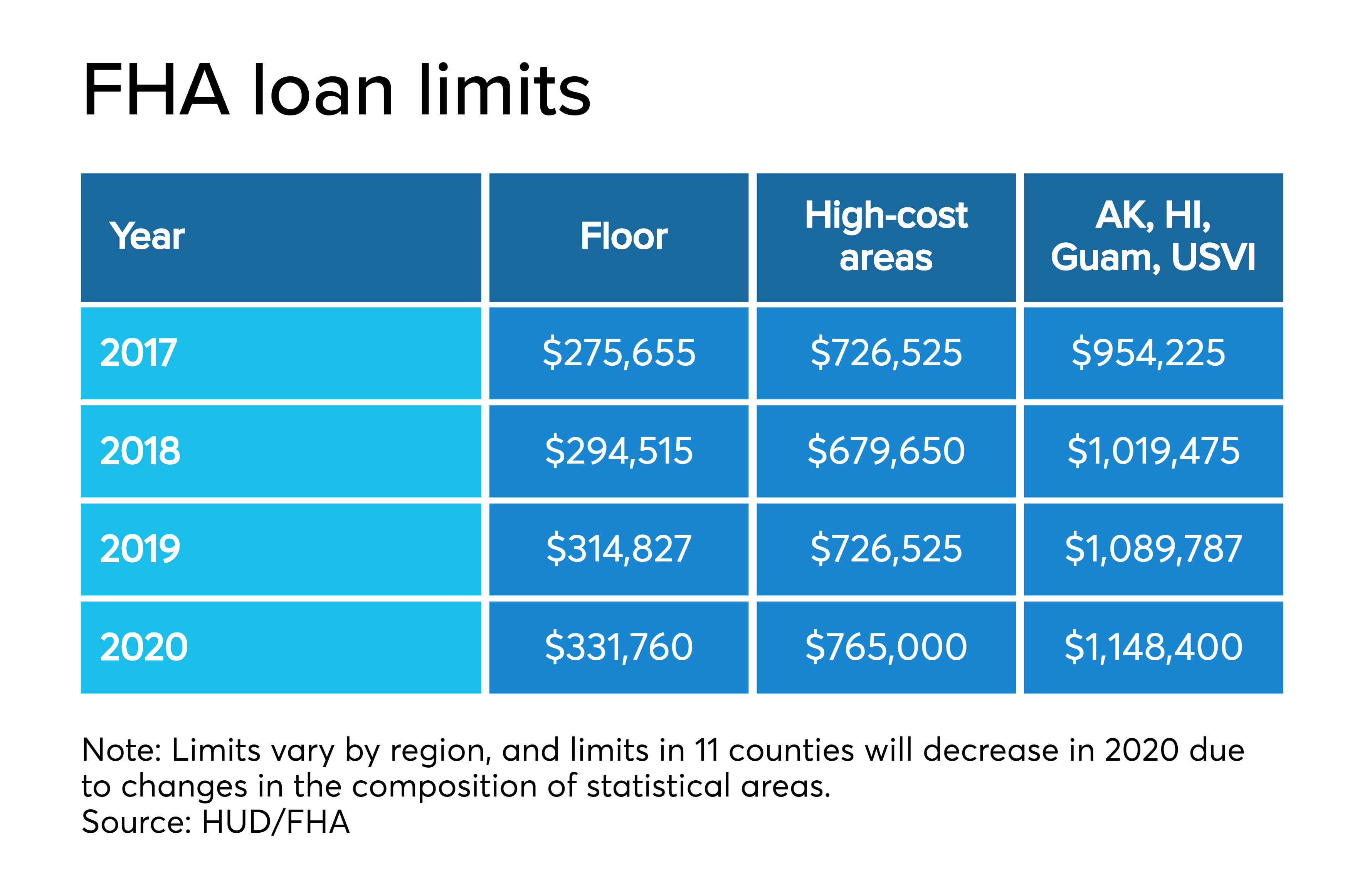

FHA Mortgage Insurance Premiums Lowered in 2023, There is also a different loan limit. Fha loans require mortgage insurance for either 11 years or the full term, depending on your down payment and other variables.

FHA Loans Everything You Need to Know, This fee is refundable when you refinance into another fha loan, like. Borrowers with scores below 580 may still qualify with a 10% down payment rather than 3.5%.

FHA Annual Mortgage Insurance Premiums Reduced for 2023 Loans, How much does fha mortgage insurance cost? Updated march 1, 2024 • 3 min read.

FHA Minimum Credit Score Requirements for Loans in 2024, For most fha loans, the cost of mortgage insurance is 0.55% of the mortgage loan amount annually, and 1.75% of the loan amount upfront. Pennymac requires a 620 score on its fha loans.

Fha Loan Limits, How long will you pay fha mip? So if you borrowed $150,000, you’d be required to pay an upfront fee of $2,625.

What Are the FHA Loan Requirements 2024? TIME Stamped, If so, you may still qualify for a loan backed by the federal housing administration (fha). 2024 fha annual mip rates.

FHA Mortgage Insurance Guidelines Required on FHA Loans, No requirement for large down payment. First, there’s an upfront mortgage insurance premium of 1.75% of the total loan amount.